Signals of the Cross-Asset Type

Spillback Risks for Equity Investors

Main Points

The muted VIX response to the equity drawdown has a few suspects including low gross exposures and dealers fortified with long vol as spot has declined.

But there is a chance that equity vol is simply lagging relative to the price damage and emerging signs of market dysfunction. Markets incorporate information at different speeds. The US vol market may be behind.

Blaring signals from the cross-asset landscape include measures of illiquidity in developed sovereign bond markets as well as the prominent bid to USD calls.

Equity investors should contemplate the potential for “spillback”, a risk that results from Fed policy moving more quickly than other countries can handle.

Getting Us Underway…What’s Up with the VIX?

The VIX has simply not been responsive to both the market drawdown and the level of volatility experienced at the index level. The table below shows instances over past 20 years when 1m realized vol increased by 10 or more over a 2-month period and the VIX fell by 5 or more of same period. Street-side explanations abound, including low-gross exposures that currently constitute actively managed books and third order Greek exposures that purportedly have left hedgers longer vol on the way down in the SPX. These are “maybes”. As always, the search for cause and effect is pursued by market participants. Our collective stress levels are managed when we have some success in ascribing cause and effect. In this note, we explore some of what might be happening and also contemplate the risk for equity investors, some of which may originate outside of the stock market.

Explaining the VIX Moves Through the (Muted) Vol Surface

Some of the above – low exposures to risk either through the long parts of the portfolio or through how Greeks evolve as the SPX falls – imply a less immediate urge to hedge. This translates into flatter put skews. We show the rough co-movement of the CBOE Skew index to the beta of the front month VIX future to the SPX. If the market is sliding down a more modestly sloped skew curve, there’s less repricing of the VIX to be had.

This begs the most important question: Why are deep tails at the equity index level being disrespected? One explanation, of the somewhat circular kind, is that tail hedging has not delivered and, as a result, is not seeing the kind of demand that would steepen the skew and lead to a more reactive VIX. This can easily be confirmed. A simple strategy that buys weekly 30 delta puts on the SPX starting last December is barely in positive territory. OTM call option hedges on the VIX have delivered net losses in 2022, even as the SPX has drawn down considerably.

Markets React at Different Speeds

As we try and connect all the dots, it’s worth accepting that each market impounds information on its own timetable. A stark example of this was the Q3 2007 all-time high reached in the SPX even as credit markets were badly fracturing. With this in mind, equity investors should pay careful attention to some of the cross-asset signals currently blaring. There are warning signs in measures of illiquidity and the level of volatility in both government bond and FX markets.

Risk-Free Chaos

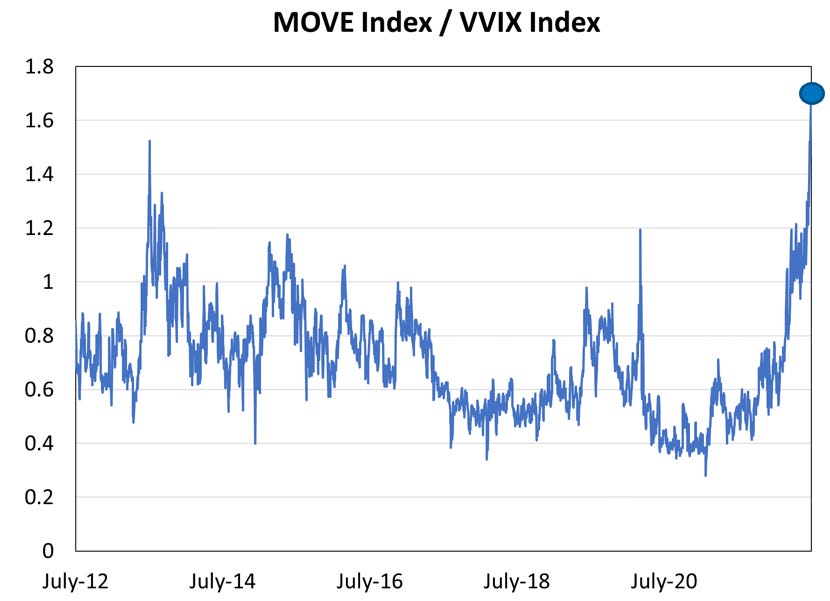

Below, a Bloomberg developed measure that measures illiquidity in the US, German and Japanese government bond markets. A time-series of swaption vols wouldn’t look too much different. Higher vol markets are sloppier markets, when prices, even in government markets, have greater tendency to stray from fair value. This is bad for basis trades that in seeking to capitalize on these mispricings, are vulnerable to relationships further fraying. When the "risk free" asset class becomes (much) less robust, it's worth considering the potential impact on the "residual" asset classes like equities. These markets have undergone substantial repricings, first in yields rising and then, just as quickly, falling fast. To further underscore the point that equity volatility is “behind” with respect to the chaotic movements in the Treasury market, below right, we present a chart of the ratio of the MOVE index to the VVIX. This “off the charts” level outstrips that even of the 2013 Taper Tantrum.

“Dolla’tility”

Equity investors also should watch currency markets. July 5th was just the second day in the last decade when gold, oil and the Euro all fell by 1.5% or more on the same day (3/6/15 was the other day). July 6th is seeing similar price pressure on this trio. These assets share a common risk factor – their negative correlation to the USD. For each to suffer large losses on the same day speaks to the increasing prominence of the dollar as a driving risk factor. We can see similar risk in vol surfaces for major FX pairs. Here we show 1m 25 delta risk reversals for EUR, JPY, GPB and AUD. All of these vol skews register in very low percentiles, illustrating the demand for dollar calls that has emerged. It’s notable that this is consistent across “carry” currencies like AUD as well as “haven” currencies like JPY. The read-through is simply that markets are worried about the US inflation problem and the speed with which its rate adjustment path may surpass that of other developed market countries.

“Spillback”

In 2014, as the Fed sought to get off zero and normalize policy, the IMF introduced the concept of “spillback”, a warning to the US Central Bank that its policy changes can create spillovers (in EM, for example) that then spillback into the US. Eight years later, the risk here appears more than acute. To wit, the BoJ seeking to hold the line on yield curve control and the ECB (remarkably) forced to attend to “fragmentation” (of bond market spreads) with new extraordinary measures even as it is trying to get out of the business of extraordinary policy. It feels more than a little bit dicey. A chief concern here is that when markets move fast, things break. And while the equity drawdown has been substantial, there may be more to come if market liquidity pushes risk premium (VIX) higher. Deteriorating market prices create all kinds of trouble via knock-on effects.